Automate & Digitize Insurance Contracts with IFRS 17

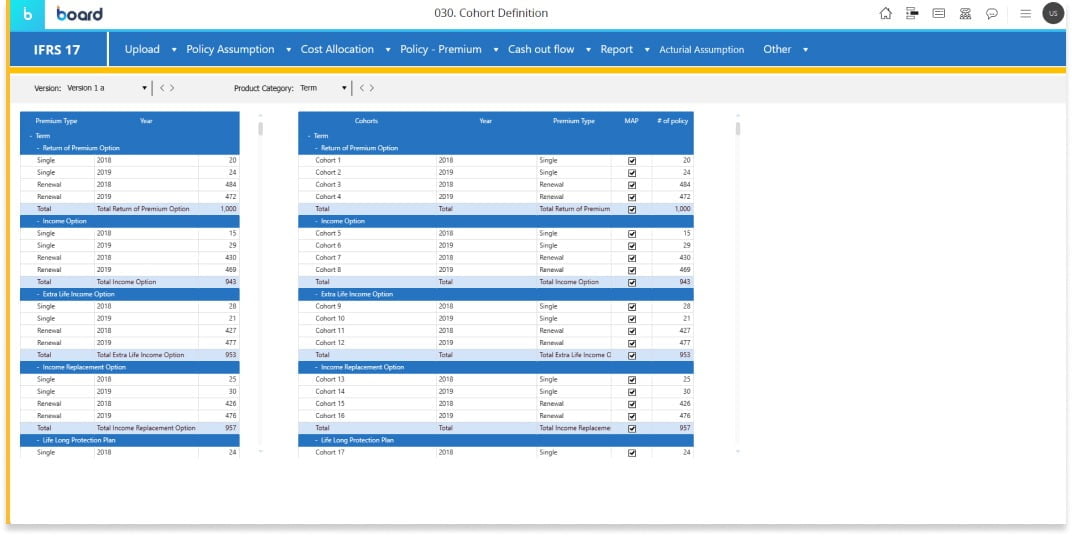

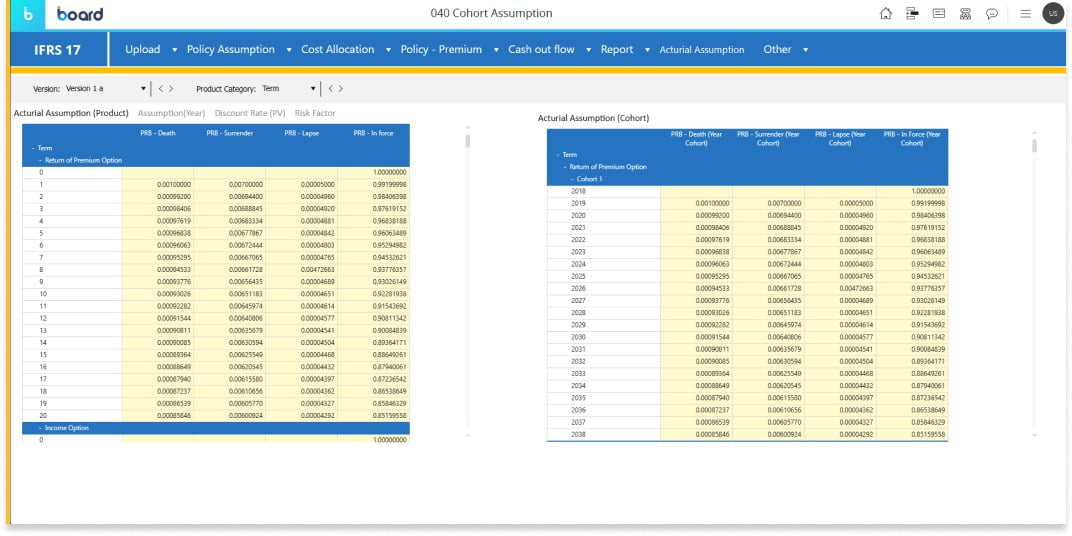

- Define Assumptions at the Cohort Level

- Define Force Policy at the Cohort Level

- Assume Discount and Risk Factors

- Streamline Cost Allocation

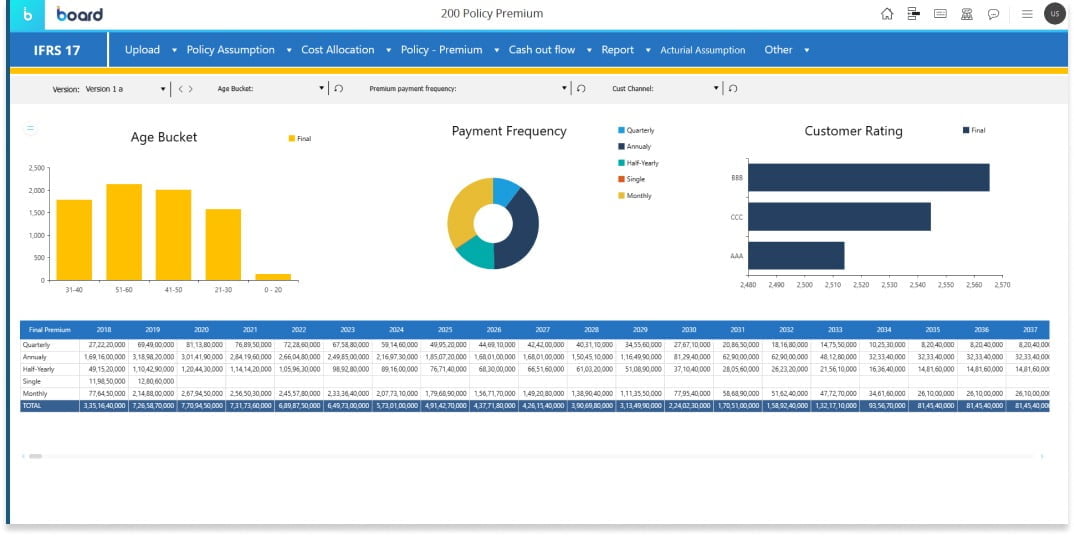

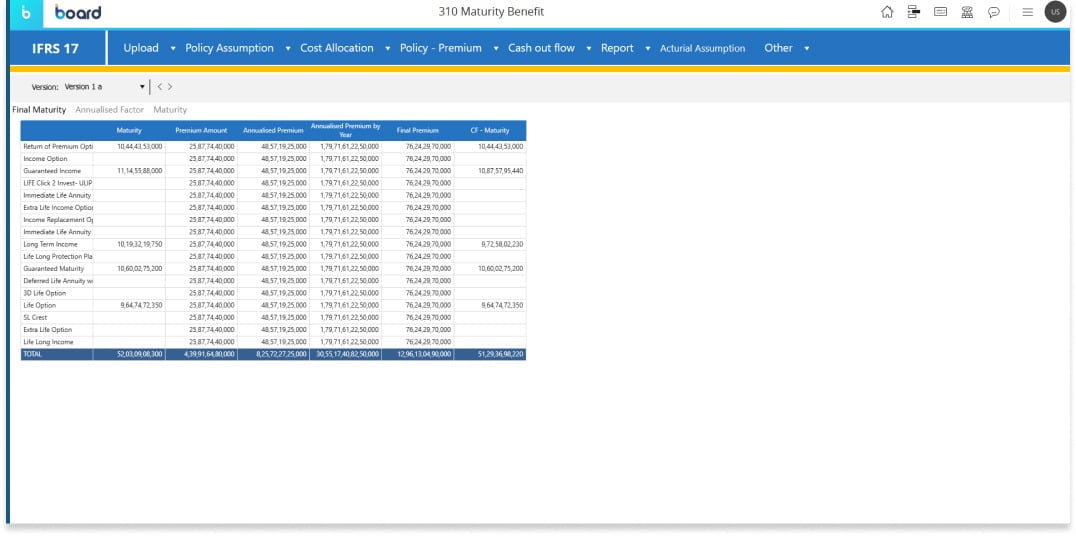

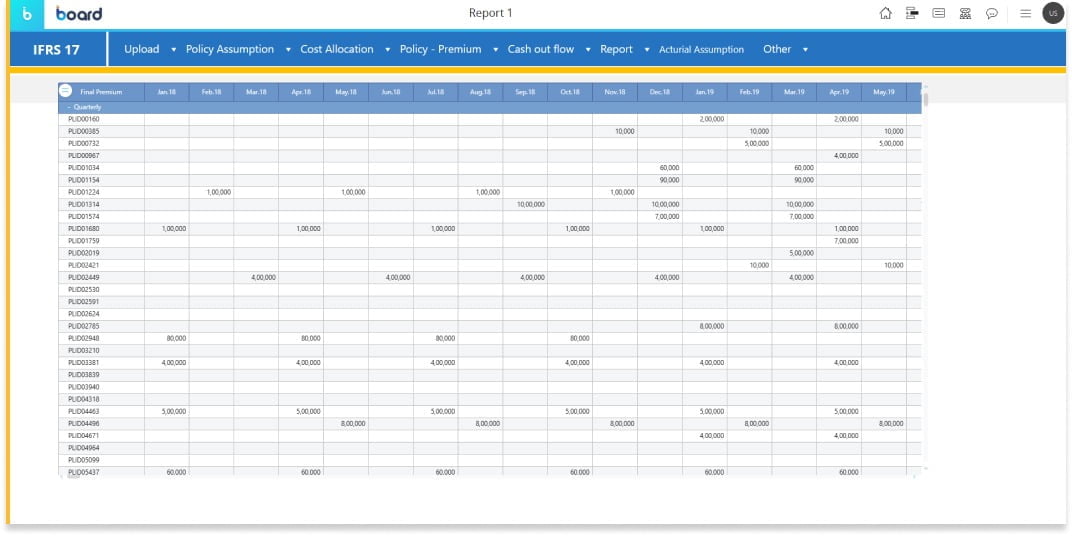

- Better Cash Flow Generation

Financial Reporting with IFRS 17

IFRS 17 is a new International Financial Reporting Standard that replaces IFRS 4 on accounting for insurance contracts. Our objective is to automate and digitalize the application of IFRS 17 for life insurance contracts, making it easier for insurance companies to generate cash flows.

Implementing IFRS 17 can be a complex and time-consuming task, especially when it comes to calculating cash flows. That’s why we offer a comprehensive solution that takes care of all your IFRS 17 needs.

Some Out-of-the-Box Features

Policy

Reporting

Experience

Expenses

IFRS - Manage Your Insurance Contracts Like Never Before!

Key Benefits of IFRS 17

- Reduced Complexity for Insurance Contracts

- Increased Confidence in Financial Reporting

- Premium Allocation Approach

- Improved Risk Management

- Increased Transparency and Disclosure

Industry Specific Blueprints

Industry

Services

Services

Services

Services

Industry

Industry

Improve Financial reporting with IFRS 17

IFRS 17 is designed to simplify complex financial reporting processes. It introduces a new approach to accounting for insurance contracts, making it easier for companies to provide transparent and comparable information to stakeholders. With improved data quality and better decision-making capabilities, businesses can make more informed choices and stay ahead of the competition.

Our intuitive interface allows you to input actuarial assumptions for different product categories, discount factors, risk factors, and more in just a few clicks. You can also define an allocation matrix based on factors such as cost center, allocation driver, and cohort level.

By leveraging the power of IFRS 17, you can make use of data for better decisions that drive profitability by identifying areas of improvement, optimizing resources, and allocating funds effectively.

Try IFRS 17 today and experience the difference for yourself.

Contact us

Fill in the details!

Contact us

Fill in the details!

Our Offices

Expanding Horizons, Elevating Excellence!