REPLAN A Robust General Insurance Planning Software

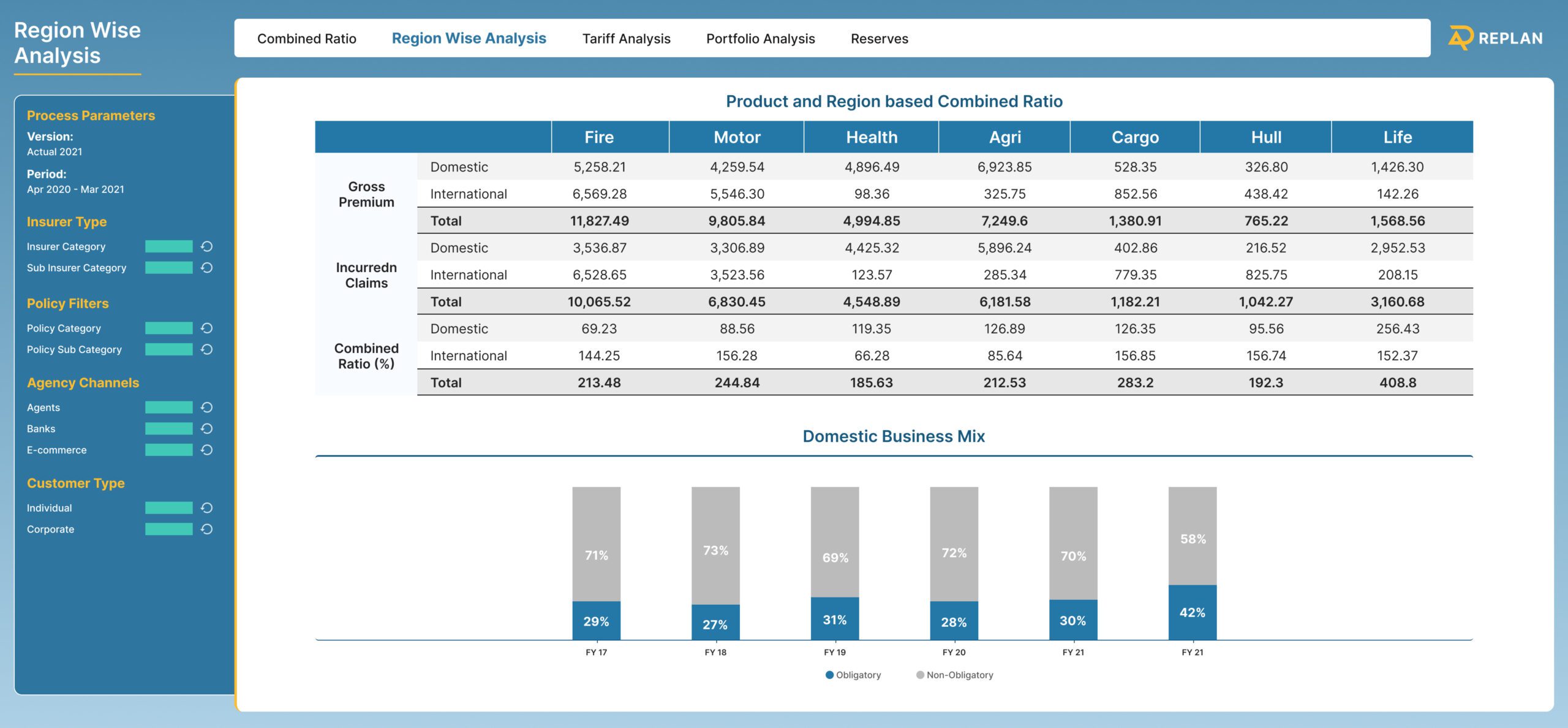

- Combined Ratio

- Assets Under Management (AUM)

- Effective Tariff

- Business Mix

- Realized return and Investment Leverage

Some Features of General Insurance ERP Software

REPLAN - General Insurance Business Planning with Ease

Effective Tariff

Represents the average premium rate actually charged to customers, compared to the base or published rate. It reflects how effective tariffs affect profitability alongside risk profiles. The business may identify opportunities to adjust pricing strategies for different customer segments or risk categories.

Business Mix

Refers to the distribution of premiums across different insurance lines (e.g., auto, property, health). The business can evaluate the profitability and risk associated with each business line within the mix. This helps optimize product offerings, identify areas for expansion, and manage overall portfolio risk.

Realized return and Investment Leverage

Realised return directly affects a general insurer’s profitability. Strong realised returns can contribute to underwriting profitability by generating additional income and vice-versa. Investment leverage refers to the use of debt financing to amplify investment returns. In general insurance companies, this is less common than in other industries due to the need for solvency and regulatory constraints.

Key Benefits of REPLAN

- Reduce Time of Implementation

- Best Practices will be part of the Solution

- Fully Configurable as per Customer requirement

- Fully Integrated with Core FP&A Platform

- Pre-configured Scalable solution

Industry Specific Blueprints

Industry

Services

Services

Services

Services

Industry

Industry

Insurance ERP Software to Make Your Business Smarter

REPLAN offers a comprehensive enterprise planning solution for general insurance companies looking to streamline their financial planning and underwriting processes. With interactive features, REPLAN provides valuable insights to help companies make data-driven decisions and drive business growth.

Additionally, our software includes tools for managing gross written premium, reinsurance, net written premium, etc to provide companies with a complete picture of their financial health.

By implementing REPLAN, general insurance companies can improve their financial performance, enhance their risk management strategies, and stay ahead of the competition.

Contact us

Fill in the details!

Contact us

Fill in the details!

Our Offices

Expanding Horizons, Elevating Excellence!